Getting Started

What is Cash App Afterpay?

Cash App Afterpay lets your customers make purchases and pay for their purchases over time. When customers pay each installment on time, using Cash App Afterpay is free.

Some customers qualify for Pay Monthly, which offers credit with interest payable between 3 to 24 months.

Why use Cash App Afterpay?

For merchants:

- We pay you upfront and take on all credit and fraud risk

- We help raise your Average Order Value (AOV) and conversion rates by increasing purchasing power

- Customers look to Cash App Afterpay to discover new brands, providing merchants with a valuable source of new customers

For customers:

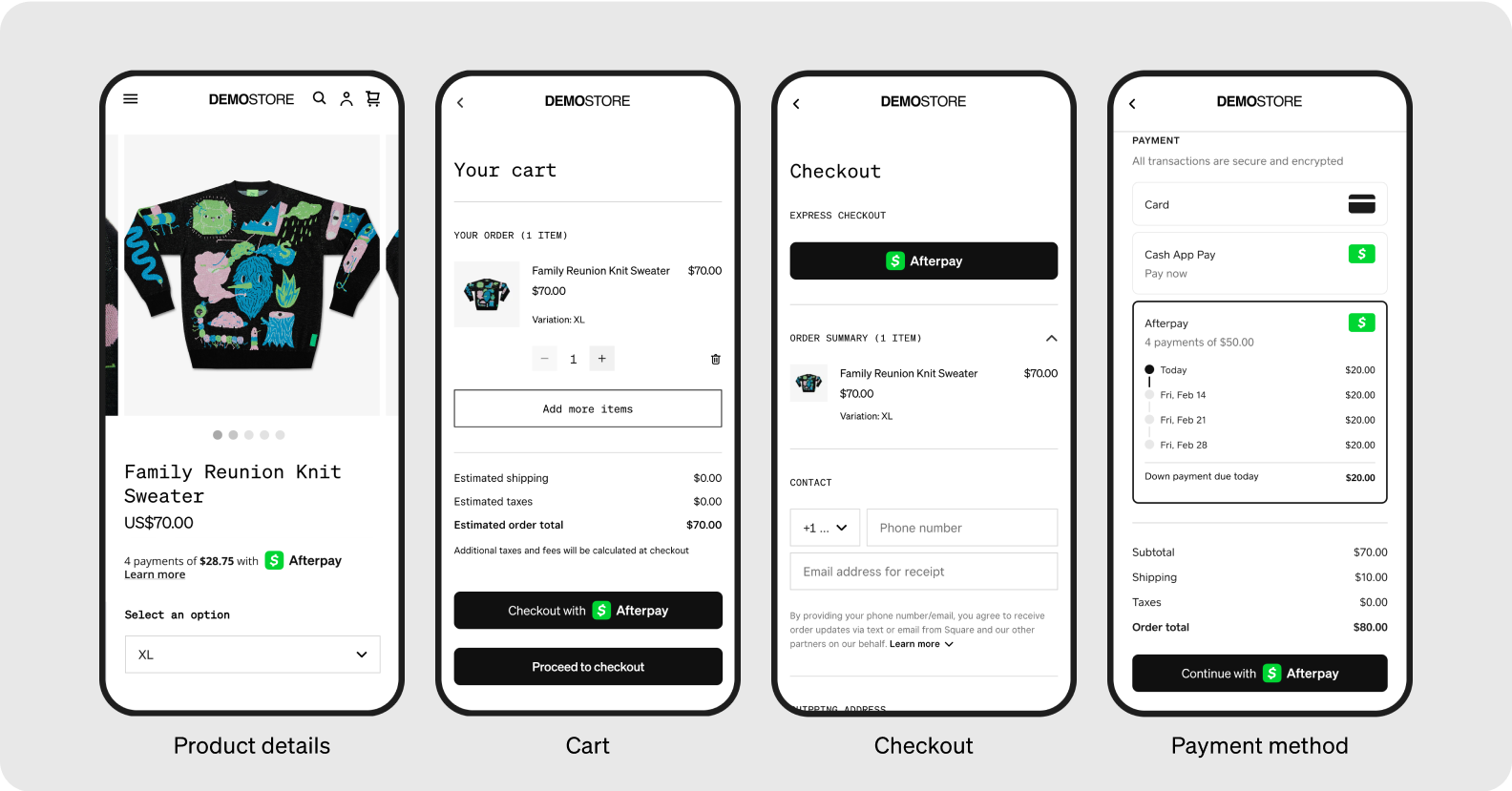

- We split the total order amount into four installments, taken automatically every two weeks

- It’s free and simple to join - just download the app, then set up an account in minutes. Eligibility criteria apply

- There is no interest with Pay-in-4 and no fees when customers pay on time. Customers who qualify can use Pay Monthly, where payment is spread over 3, 6, 12 or 24 months with interest.

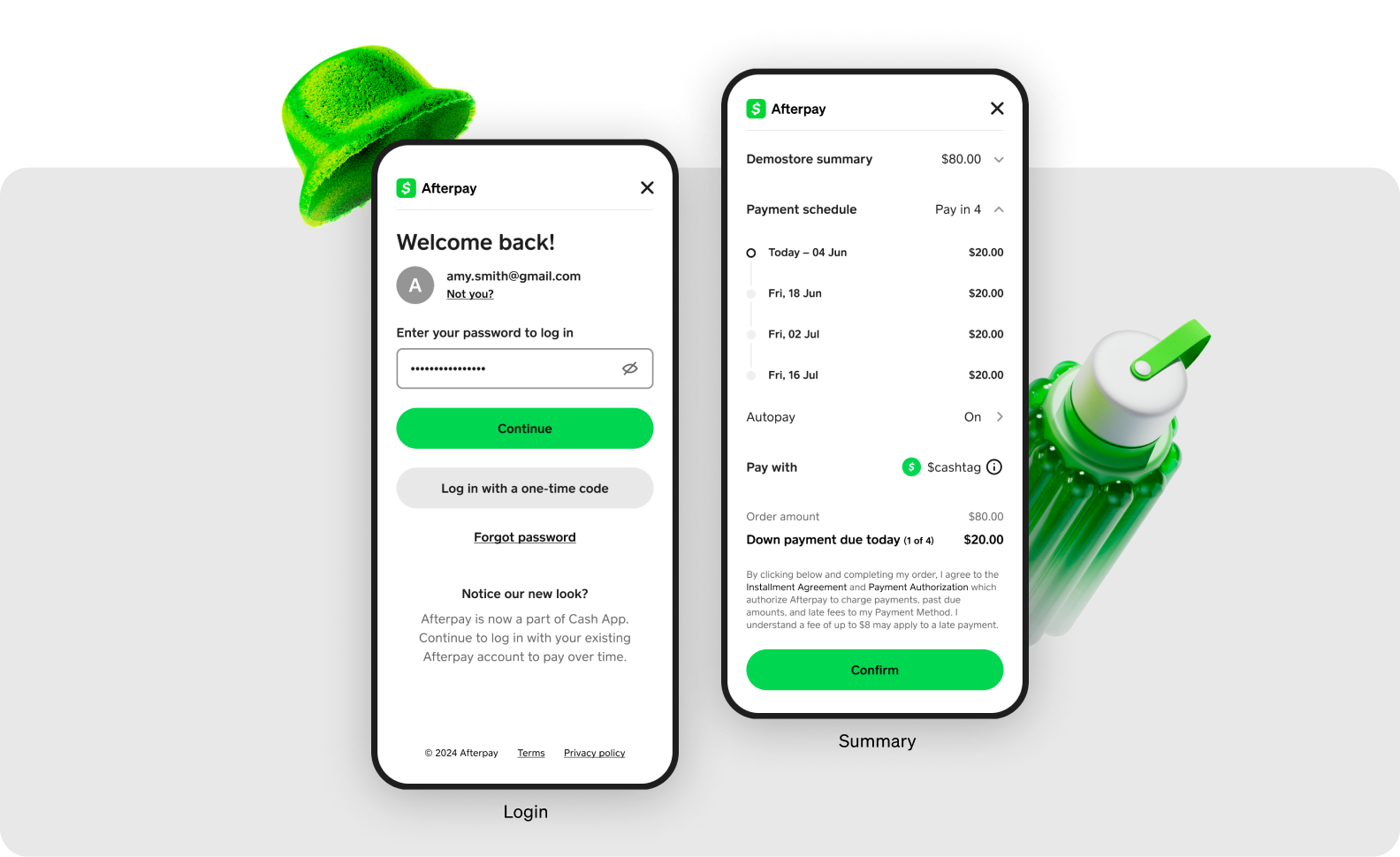

- Customers can use their Cash App account to pay for purchases in four installments

How is Cash App Afterpay different from Afterpay?

In the United States, Afterpay is now called Cash App Afterpay. It’s available to both Afterpay and Cash App customers through a single checkout experience.

For merchants who previously offered Afterpay to US customers, Cash App Afterpay has a different logo and small changes to the Afterpay messaging on your product and checkout pages. There aren’t many changes to your backend operations, payment processing, settlement, or other technical processes.

Important

If your app uses an explicit allowlist of Afterpay domains, you must addapi.cash.app and cash.app to the allowlist.

Migrate to Cash App Afterpay

If you’re an existing US merchant who needs to migrate from Afterpay to Cash App Afterpay, see instructions here.