Payment Flow Operations

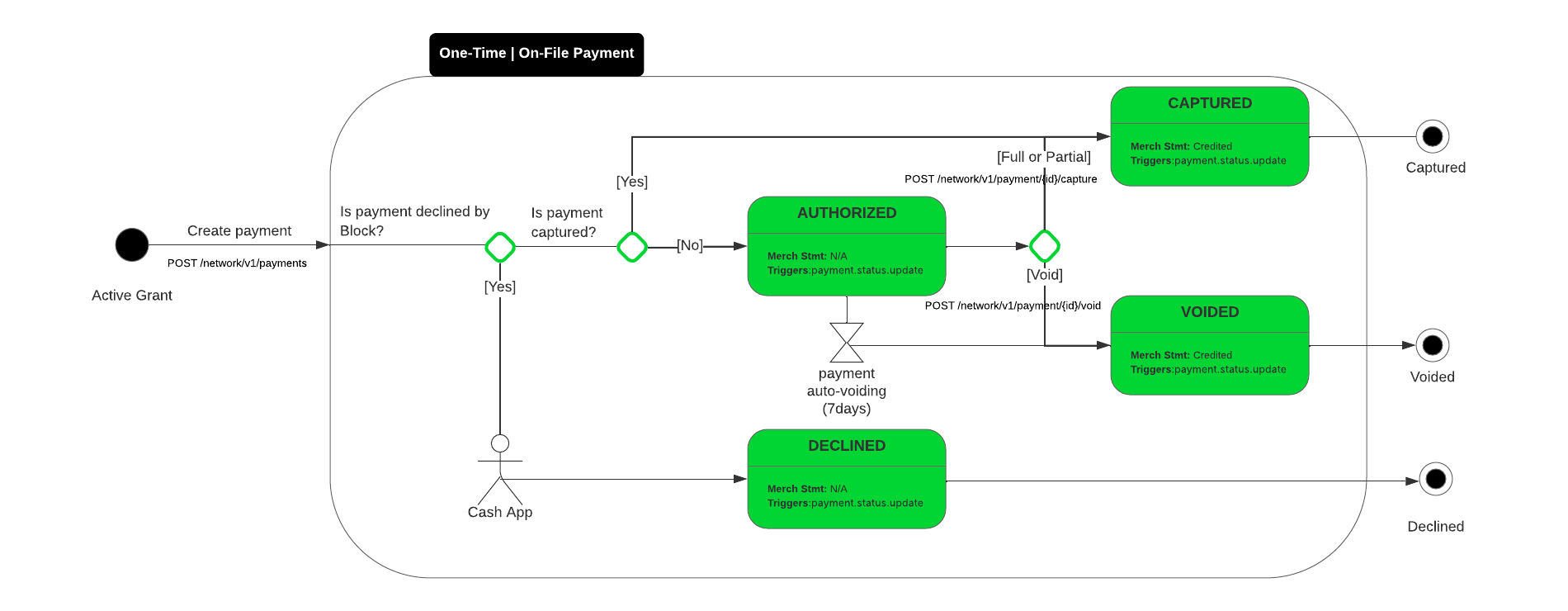

Cash App Pay (CAP) Payments follow a dual-message, authorization-capture model. Additionally, Payments require a separate Customer Request to complete a Payment.

Thus, there are three actions required to process a payment:

- Customer request

- Payment authorization

- Payment capture

For the purposes of this Payment Flow Operations section, M/PSP refers to a Merchant or PSP acting on behalf of a Merchant.”,

Customer Request and Grant

To get permission to initiate a Payment or issue a Refund, a M/PSP must obtain a Grant after receiving a Customer Request to use CAP. A Grant represents a Customer’s approval for a Merchant to take a specific Transaction-related action on their behalf. These actions are listed in Action Types below.

Once a Grant is obtained, a M/PSP can perform the action on behalf of the Customer.”,

Action types

The following table describes what action is permitted with a Grant for each action type:

Payment Authorization

Authorizations are valid for and must be captured within seven days to complete a Payment. Authorizations not captured within seven days will be voided, and a new authorization will be required to complete a Payment.

Some Payment types require additional data during authorization:

- Recurring Payments: Authorizations for recurring payments should indicate that the Payment is part of a recurring series. Failure to do so may result in elevated decline rates.

Payment Authorization Failure Scenarios & Codes

Payment Capture

Once a Payment has been authorized, it must be captured within seven days to complete the Payment and trigger the settlement process for the M/PSP to receive funds.

Generally, a M/PSP must capture a Payment for the amount of authorization. A M/PSP may capture an amount that is different than the authorization value in two cases:

- Pre-authorization / Partial Capture

- A M/PSP is mitigating Payment risk from a Customer before goods are delivered or services are rendered by authorizing an amount that will be higher than the final Payment value. For example, at gas stations, rental deposits.

- Over-Capture

- A Merchant is including supplementary items to the original authorized Payment. This is typically used to add gratuity or other incidental fees. The amount of funds captured over the authorization amount is not guaranteed.

Capture Failure Scenarios & Codes

Generally, once a Payment is authorized, the funds are safe for capture. However, a capture may fail after a successful authorization in the following scenarios.

Refund

Refunds allow a M/PSP to send funds from a Merchant to a Customer.

Refunds are related to a previously captured Payment. They must not have an amount greater than the captured amount on the original Payment. There is no time limit to issue a Refund.

Refunds typically process in 7 to 10 business days following initiation. Transaction fees are not returned to the PSP in the event of a Refund.

Refund Authorization

Authorizations are valid for and must be captured within seven days to complete a Refund. Authorizations not captured within seven days are voided, and a new authorization will be required to complete a Refund.

Refund Authorization Failure Scenarios & Error Codes

Refund Capture

Once a Refund has been authorized, it must be captured within seven days to complete the Refund and trigger the settlement process. Refund captures only capture the exact amount that was authorized; Refunds may not be over or under-captured.

Refund Capture Failure Scenarios & Error Codes

Generally, once a Refund is authorized, it is safe for capture. However, a capture may fail after a successful authorization in the following scenarios: